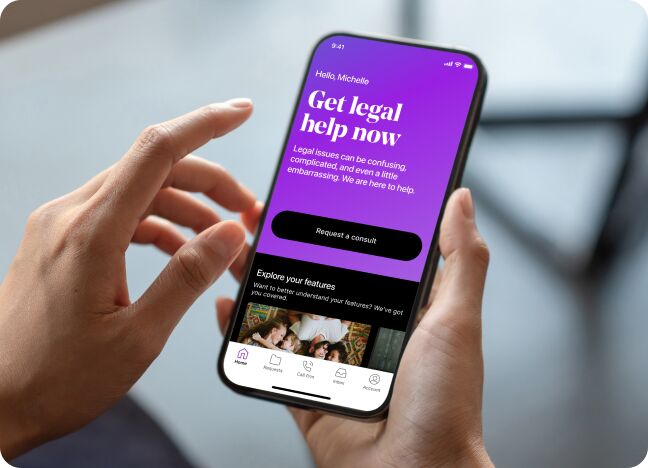

Instead of paying a lawyer by the hour, pay a small monthly fee and get access to a lawyer that can advise you on a huge variety of issues—but without a huge bill.

Use the app or a computer to pick a legal category.

Within a business day.

Deal with your legal issue then let happiness ensue! 🎉

Check out all the ways we can help.

Getting divorced? Adopting? Want a prenup? Need help with a child custody issue? That’s why we’re here.*

Having a tough time returning something? Is a company refusing to honor their warranty? Getting audited? We’ve got you.*

annual savings for members

people protected by LegalShield

businesses protected by LegalShield

LegalShield in the news

We provide legal help for you, your family, or your business.

Legal advice on an unlimited number of personal legal issues from lawyers with an average of 22 years of experience.

Plan includes:

plans starting at

Advice on business legal issues, including document review, help with debt collection, and more.

Plan includes:

plans starting at

ls-new-homepage

2681519Legal

landingpage

By signing up, you agree to receive emails from LegalShield. View our Privacy Policy